The concerned Individual has to physically visit the nearest Tax Payer's Service Office or Inland Revenue Department with a copy of the citizenship and passport size photo to obtain PAN No. (Permanent Account Number). But, with Covid-19 disrupting daily life and restricting the movements, the Inland Revenue Department has finally decided to have it automated through its Online System.

If you haven't yet registered for Permanent Account Number, you can do so by following the steps below:

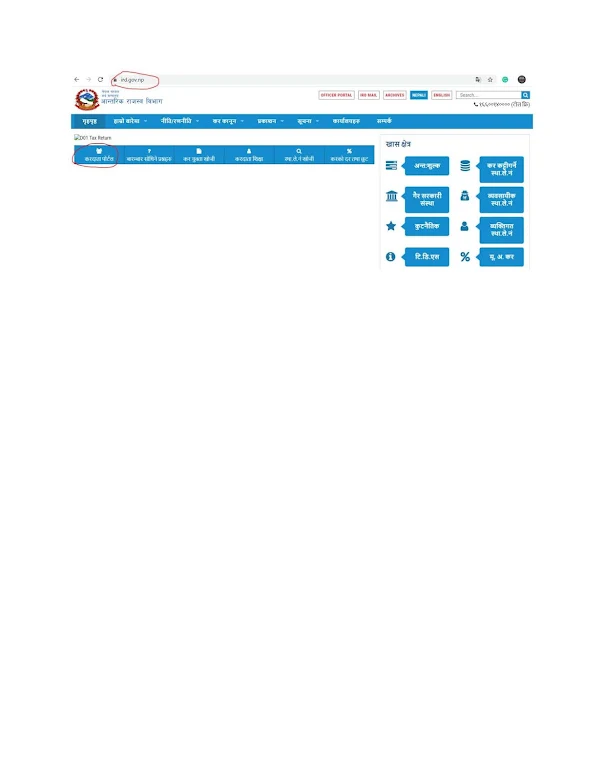

1) Visit www.ird.gov.np and click on Taxpayer Portal

2) Click on Registration then, Application for Registration

3) Fill out the necessary detail & click Ok.

Once that is done, it will be now going to the concerned IRD office for verification. Tax Officer will go through the detail submitted and verify it

4) Once verified, the concerned individual can log into tho the Tax Payer Portal system with the credentials provided earlier and obtain the PAN no.

5) If an individual needs a hard copy of the PAN no., he/she should visit the concerned Inland Revenue Office or Tax Payer's Service Office. with the citizenship certificate.

Note: The process prescribed is for the individual permanent account number for the entity, they should visit the nearest Tax Office with the authorized letter and the registration documents.

Comments

Post a Comment